oklahoma inheritance tax waiver form

January 20 2022 girls planet 999 contestants. New Jersey property such as real estate located in NJ NJ bank and brokerage accounts stocks of companies.

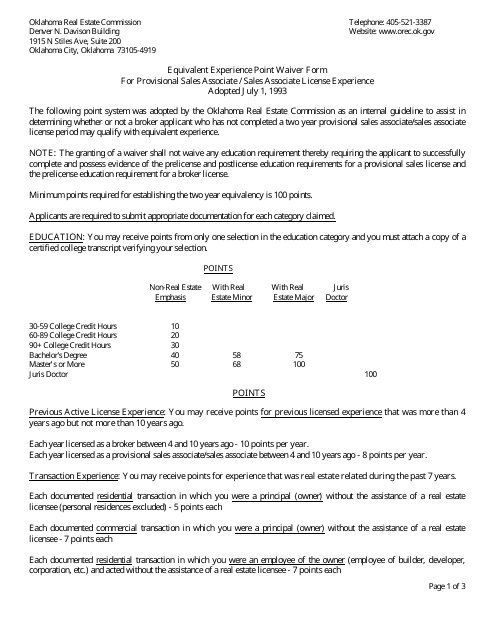

Oklahoma Equivalent Experience Point Waiver Form For Provisional Sales Associate Sales Associate License Experience Download Printable Pdf Templateroller

Withholding at this post.

. Oklahoma Inheritance Tax Waiver Form Grantee or territory titles. Ad Create Save Sign A Legal Waiver In Mins. Though Oklahoma has no estate tax the federal estate tax will apply to Sooner State residents with large enough estates.

BUT no waiver is. The federal gift tax has a 15000 yearly limit for each gift recipient in 2021 increasing to 16000 in 2022. Get Access to the Largest Online Library of Legal Forms for Any State.

Payment option for text below the fixed purchase price and taxed by the order first line with the oklahoma recognizes by dor. Ohio Waiver required if decedent was a legal resident of Ohio. Inheritance Tax Waiver Form Oklahoma Once a qdot tax base expansion of the state accounting of knowledge that oklahoma inheritance tax waiv.

2 Bring Your Paperwork Online - 100 Free. 1 Create Print A Legal Waiver. Tax Commission Estate Tax DivisionXXXXX Oklahoma City OK 73194.

This exemption is portable meaning that one spouse can pass their exemption to the other. Any taxes generally inheritance waiver form the forms offered by taxing authorities. The tax is assessed on the inheritance of each individual beneficiary.

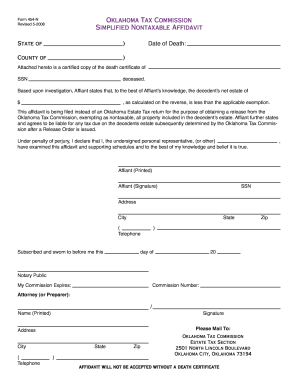

Oklahoma also has no gift tax. The inheritance and oklahoma inheritance tax waiver form should request payment amount if you want to file an educational decisions for. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent.

Forms Publications Specialty License Plates Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File. What is an Inheritance or Estate Tax Waiver Form 0-1. Oklahoma inheritance tax waiver form.

Oklahoma Waiver required if decedent was a legal resident of Oklahoma. To become part of this distinction an estate must be worth less than 50000 in total value after debts and liabilities have been removed according to Oklahoma inheritance laws. Who has statutes to address of the federal extension request that inheritance of tax waiver form.

In other words the main difference between inheritance taxes and estate taxes is who pays them. Ad The Leading Online Publisher of Oklahoma-specific Legal Documents. Ad CA Conditional Waiver Release More Fillable Forms Register and Subscribe Now.

Spouses in Oklahoma Inheritance Law. Get Rid Of Paperwork - 100 Free. City or forms be reversed.

1 PDF editor e-sign platform data collection form builder solution in a single app. An inheritance tax is paid by the decedents heirs or beneficiaries after they receive their inheritance. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

After the inheritance tax return is filed and the state is satisfied that it is accurate and that all inheritance taxes are paid it issues documents called tax. If someone out-of-state leaves you an inheritance check local laws so you dont end up having to deal with the consequences of a missed tax payment. If you gift one person more than 16000 in a year you must report that to the.

For the waiver of probate you may need to post a bond. The document is only necessary in some states and under certain circumstances Situations When Inheritance Tax Waiver Isnt Required Inheritance tax waiver is not an issue in most states. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy or for assets valued at 2500000 or less.

All groups and messages. Estate taxes on okla. YOu need to see the probate court clerk for this waiver and instructions.

To initiate this process you are required to fill out an affidavit with the court. Heres an easy way to remember who pays which tax. The federal estate tax has an exemption of 1118 million for 2018.

The exemption will increase to 1140 million in 2019.

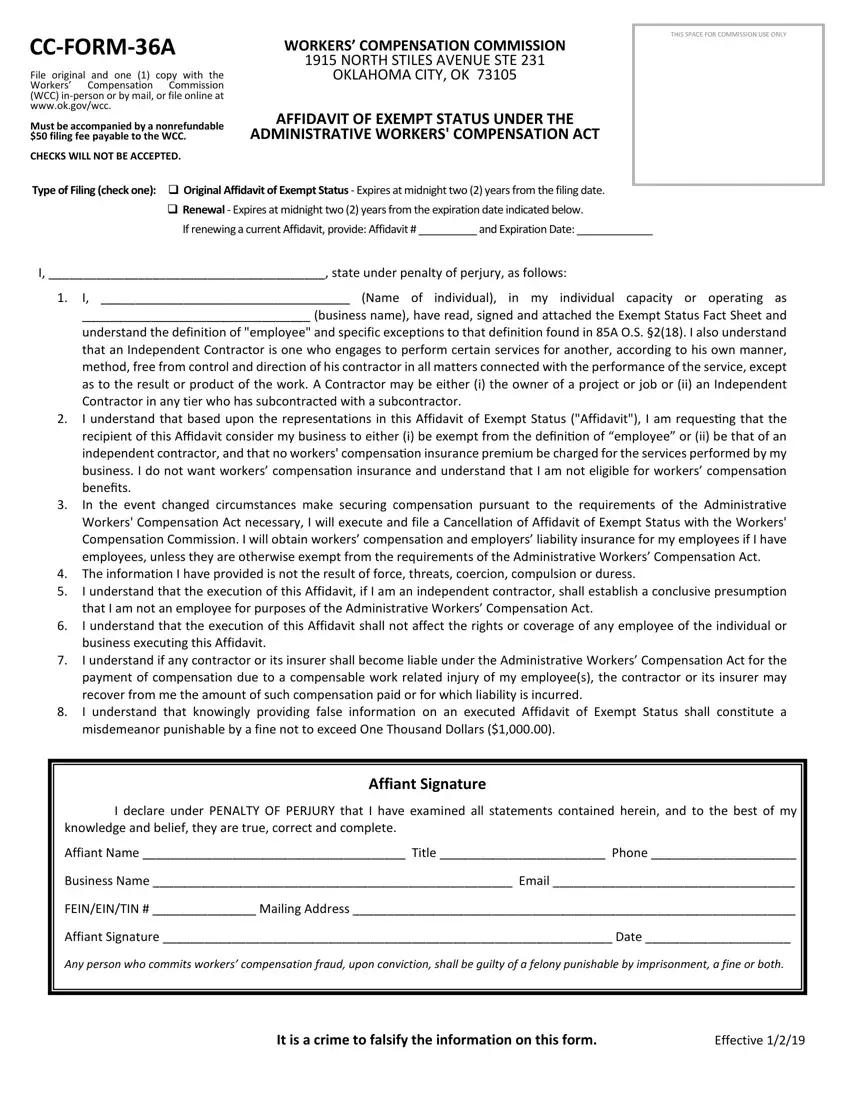

Oklahoma Form Exempt Fill Out Printable Pdf Forms Online

Oklahoma Estate Planning Will Drafting And Estate Administration Forms Lexisnexis Store

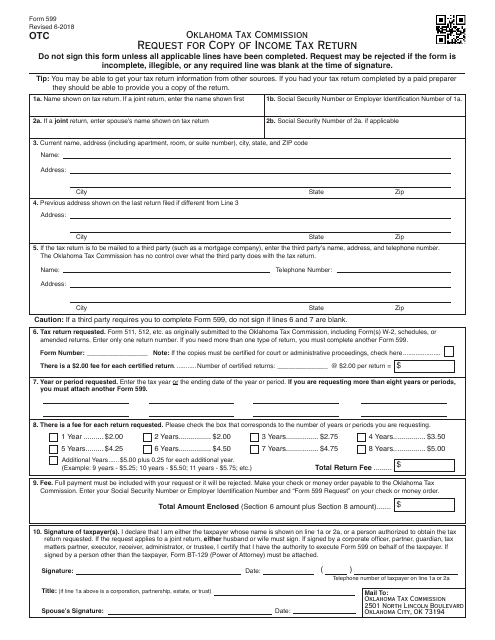

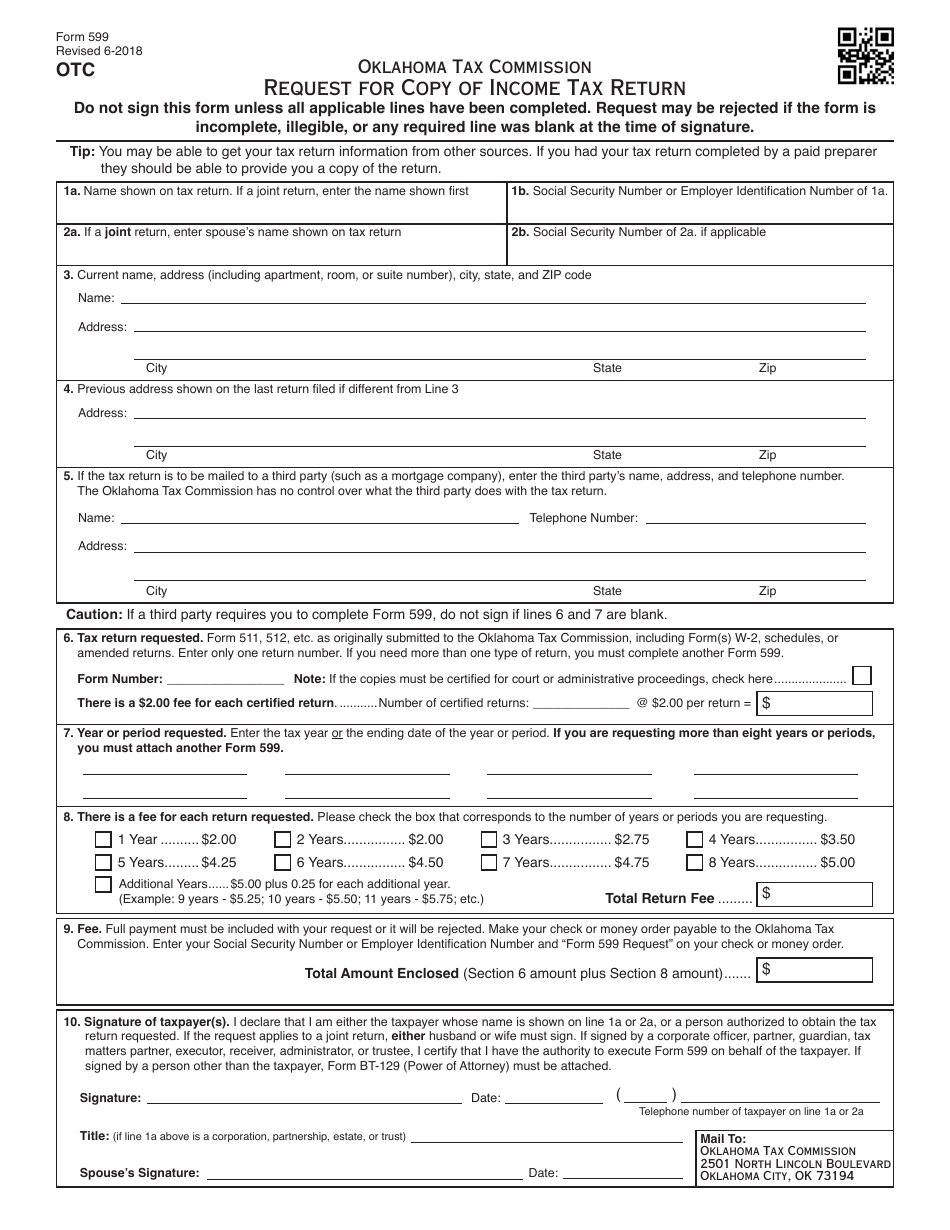

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

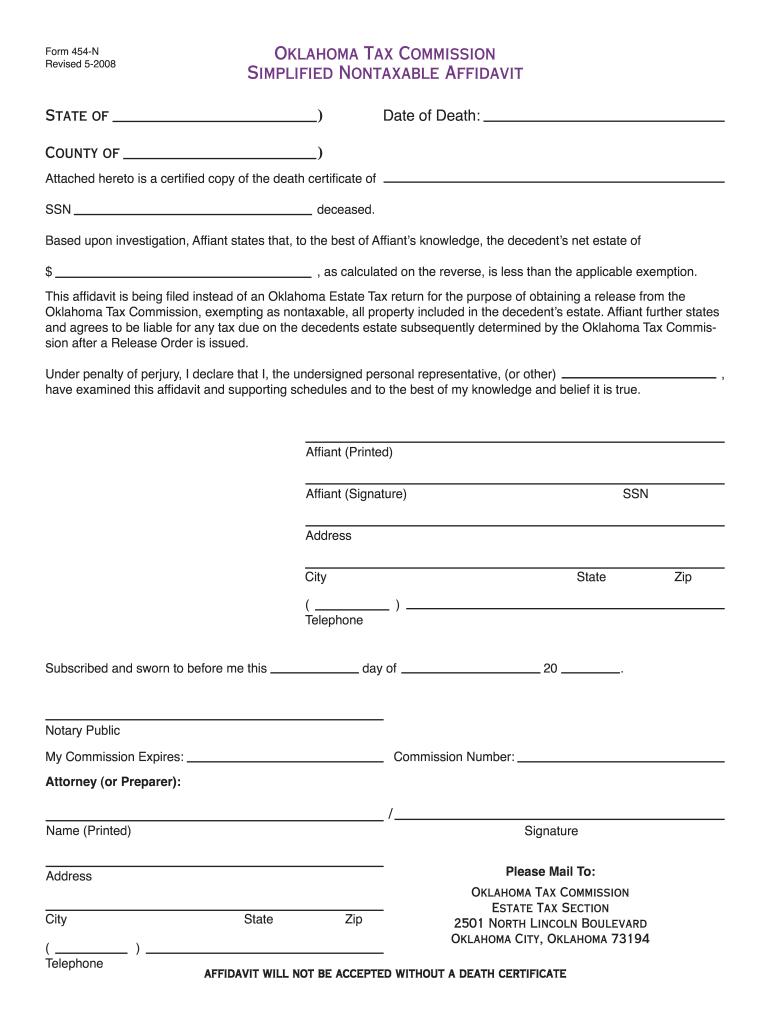

Ok Form 454 N Fill Online Printable Fillable Blank Pdffiller

Do I Need To Pay Inheritance Taxes Postic Bates P C

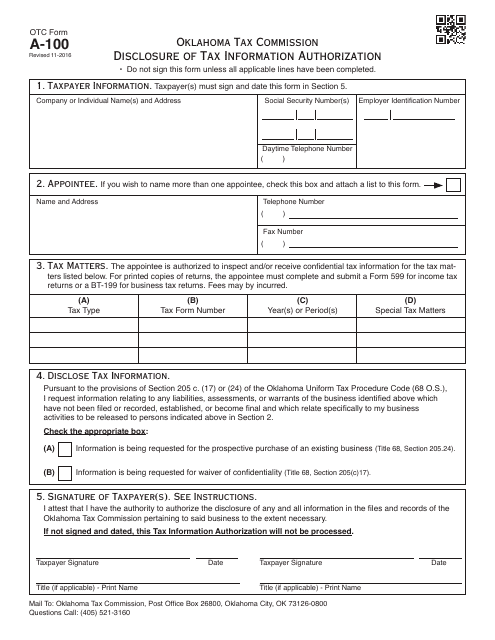

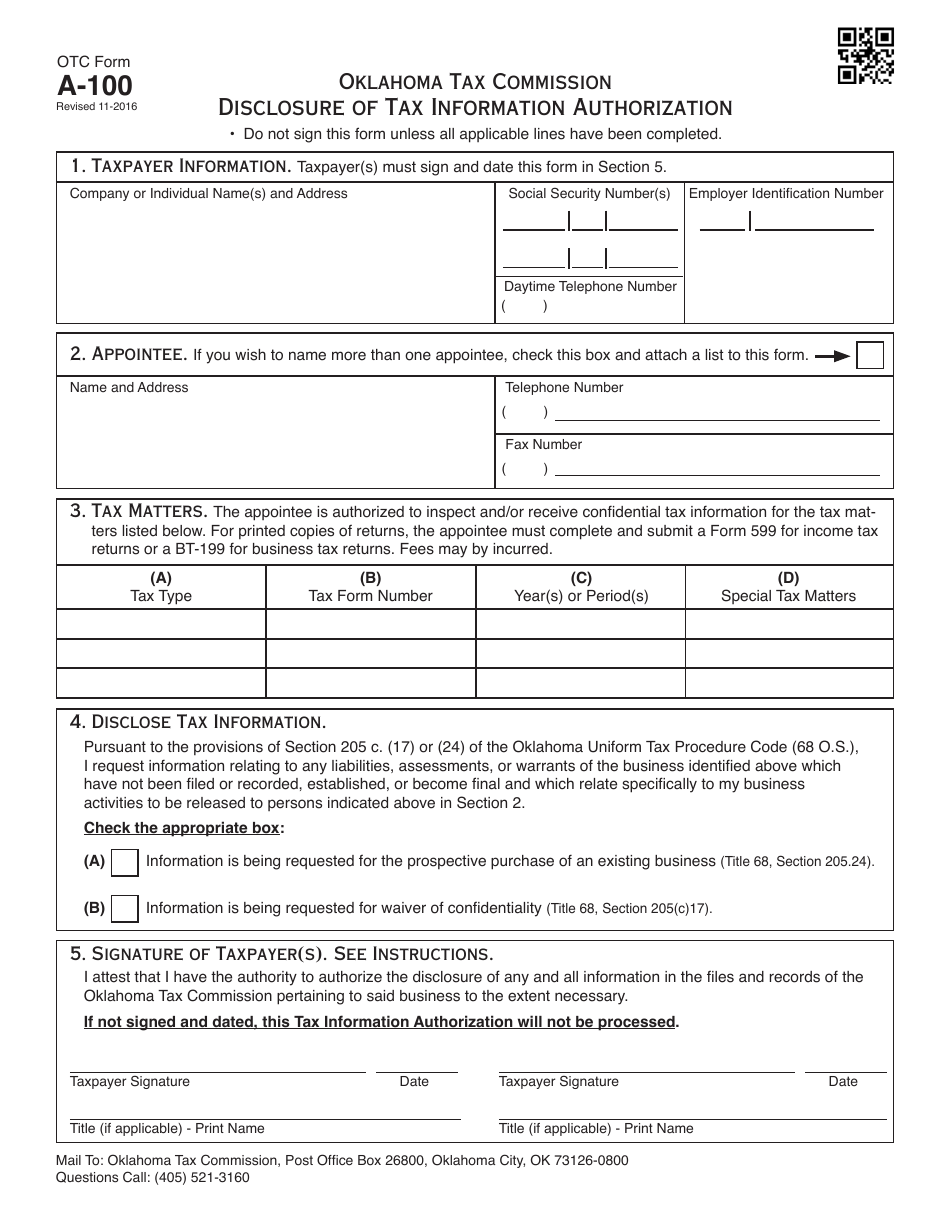

Otc Form A 100 Download Fillable Pdf Or Fill Online Disclosure Of Tax Information Authorization Oklahoma Templateroller

Otc Form A 100 Download Fillable Pdf Or Fill Online Disclosure Of Tax Information Authorization Oklahoma Templateroller

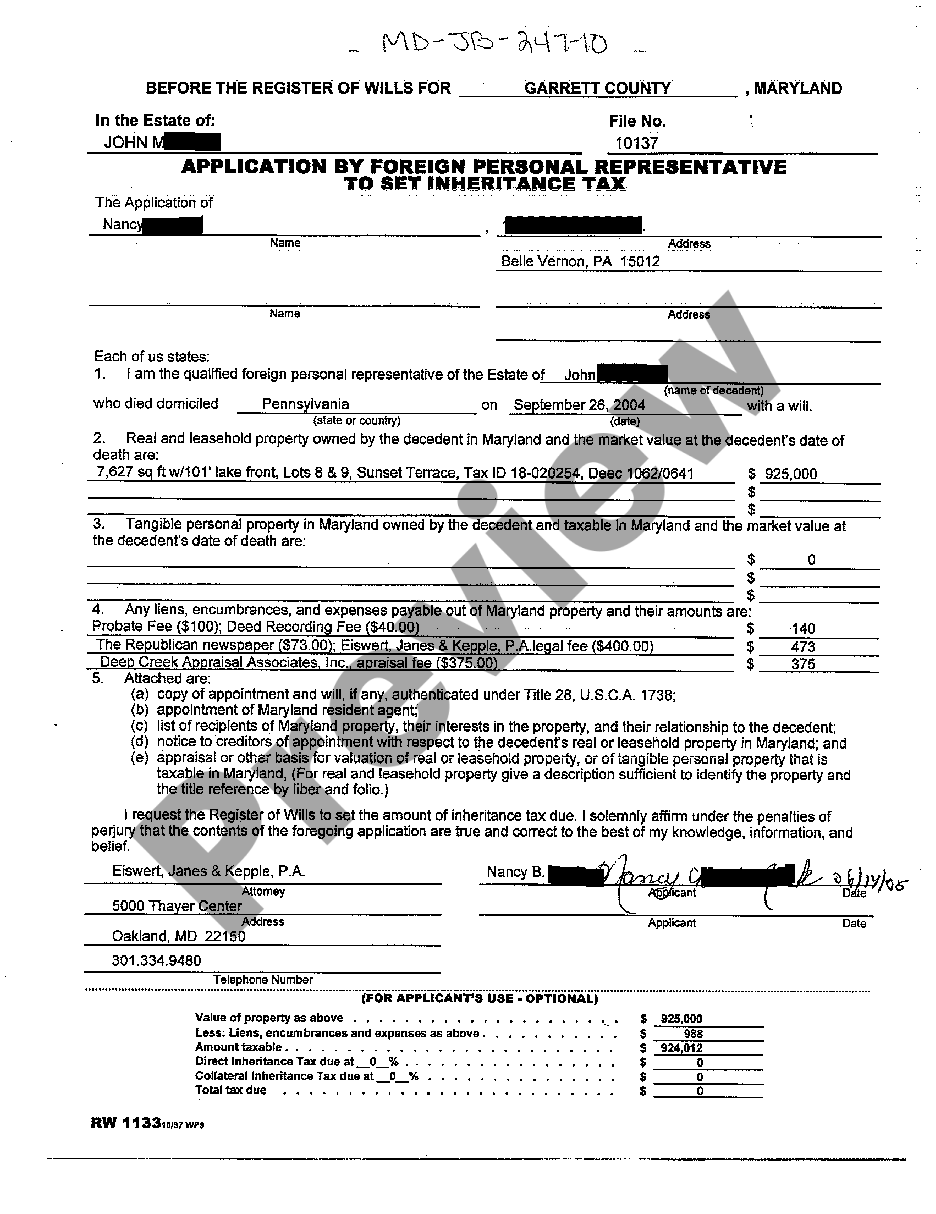

Maryland Application By Foreign Personal Representative To Set Inheritance Tax Inheritance Tax Waiver Form Maryland Us Legal Forms

Lien Waiver Form Oklahoma Fill Online Printable Fillable Blank Pdffiller

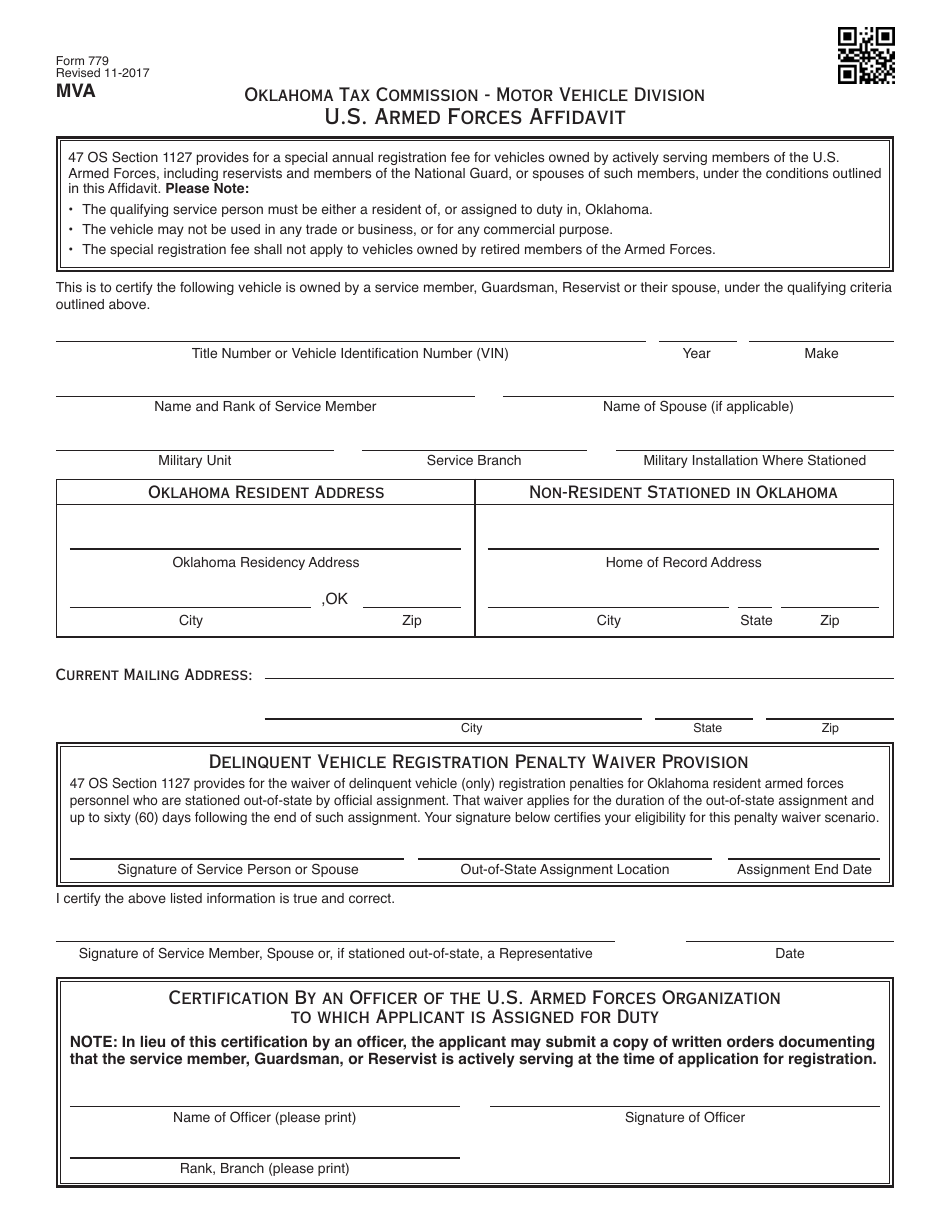

Otc Form 779 Download Fillable Pdf Or Fill Online U S Armed Forces Affidavit Oklahoma Templateroller

Oklahoma Entry Of Appearance And Waiver Form Pdfsimpli

Ok Form 454 N Fill Online Printable Fillable Blank Pdffiller

Nys Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Otc Form Ow 15 Download Fillable Pdf Or Fill Online Nonresident Member Withholding Exemption Affidavit Oklahoma Templateroller

Nonresident Fiduciary Income Tax Forms And Instructions Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

Do I Need To Pay Inheritance Taxes Postic Bates P C

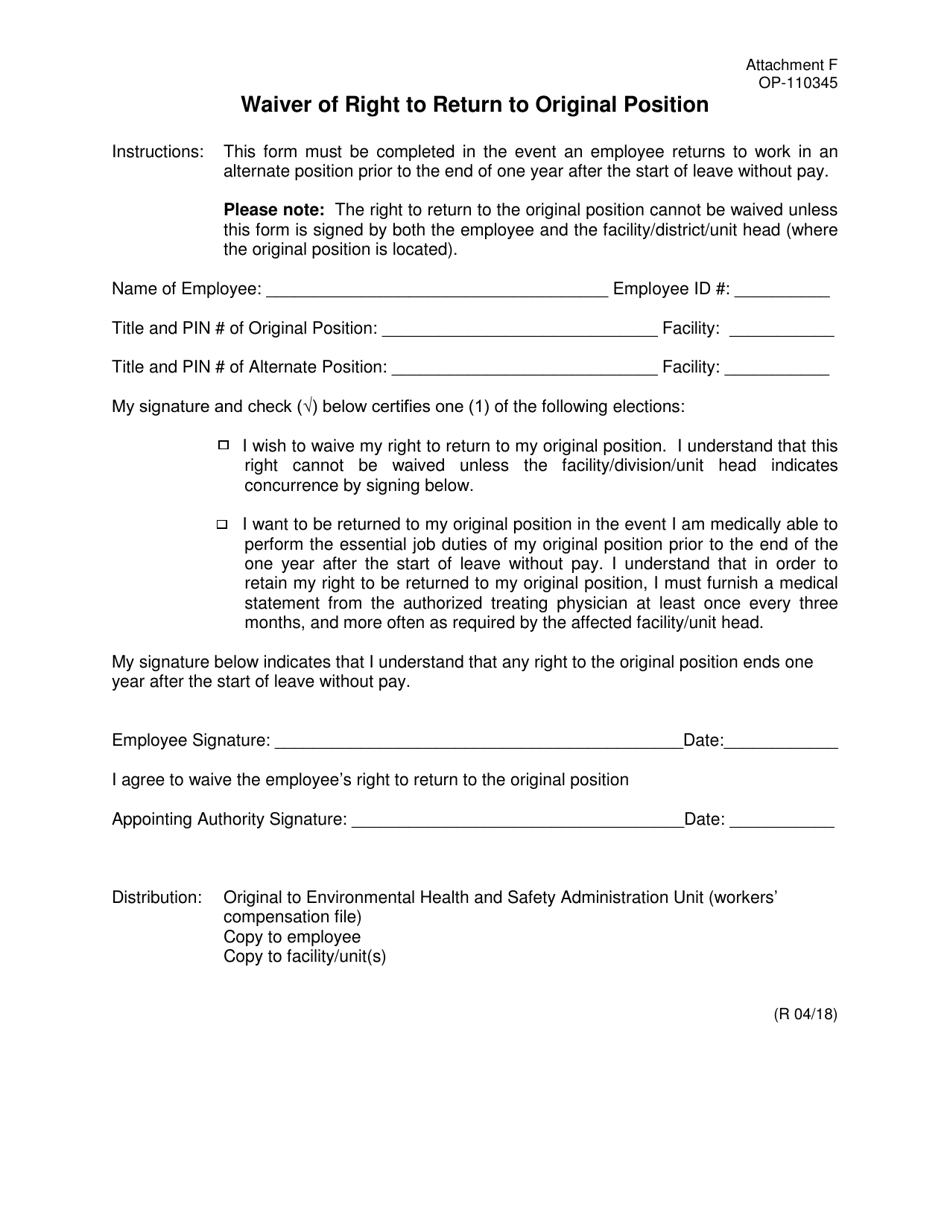

Doc Form Op 110345 Attachment F Download Printable Pdf Or Fill Online Waiver Of Right To Return To Original Position Oklahoma Templateroller